All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Surrender periods typically last three to 10 years. Because MYGA prices transform daily, RetireGuide and its companions update the adhering to tables below often. It's essential to check back for the most recent info.

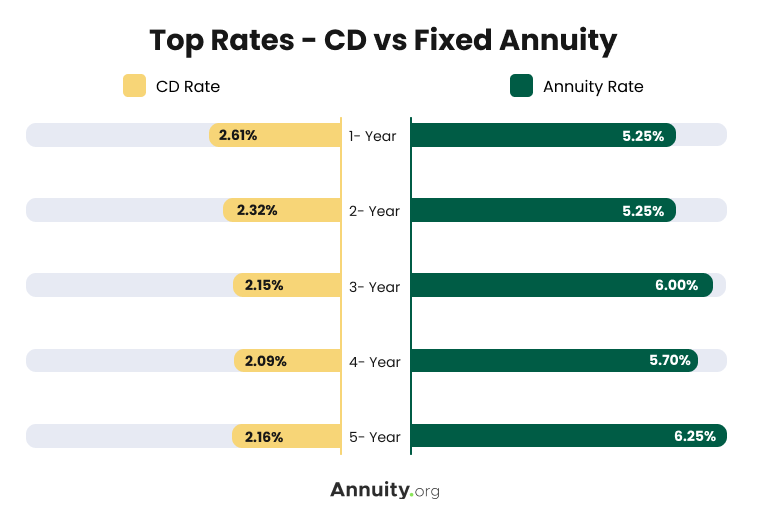

A number of factors figure out the price you'll obtain on an annuity. Annuity rates often tend to be higher when the general level of all rate of interest is greater. When going shopping for fixed annuity prices, you may find it handy to contrast rates to deposit slips (CDs), one more preferred option for safe, trusted growth.

In basic, set annuity rates outpace the prices for CDs of a comparable term. In addition to earning a higher rate, a repaired annuity might offer much better returns than a CD because annuities have the advantage of tax-deferred growth. This suggests you won't pay tax obligations on the rate of interest earned up until you start obtaining payments from the annuity, unlike CD interest, which is counted as gross income every year it's earned.

This led many experts to believe that the Fed would decrease rates in 2024. However, at a plan discussion forum in April 2024, Federal Reserve chair Jerome Powell suggested that prices might not boil down for time. Powell claimed that the Fed isn't sure when rate of interest cuts could take place, as inflation has yet to be up to the Fed's benchmark of 2%.

American Express Privileged Assets Annuity

Remember that the finest annuity prices today might be different tomorrow. Beginning with a complimentary annuity assessment to discover how annuities can help money your retirement.: Clicking will certainly take you to our partner Annuity.org.

Take into consideration the type of annuity. A 4-year fixed annuity can have a greater rate than a 10-year multi-year guaranteed annuity (MYGA).

The warranty on an annuity is only comparable to the business that provides it. If the firm you purchase your annuity from goes broke or bust, you might lose cash. Inspect a company's monetary stamina by consulting nationally recognized neutral ranking agencies, like AM Ideal. Most specialists recommend just considering insurance firms with a rating of A- or over for lasting annuities.

Annuity earnings climbs with the age of the buyer due to the fact that the income will be paid in less years, according to the Social Protection Administration. Don't be stunned if your rate is greater or reduced than somebody else's, even if it coincides product. Annuity prices are just one aspect to take into consideration when purchasing an annuity.

Recognize the fees you'll need to pay to provide your annuity and if you require to cash it out. Paying out can cost as much as 10% of the worth of your annuity, according to the Wisconsin Office of the Commissioner of Insurance coverage. On the various other hand, management charges can include up gradually.

Fl Life And Annuity Exam

Inflation Inflation can consume your annuity's worth gradually. You might consider an inflation-adjusted annuity that boosts the payments in time. Understand, though, that it will dramatically minimize your first payouts. This implies less cash early in retired life yet even more as you age. Take our totally free test & in 3 very easy steps.

Check today's listings of the most effective Multi-year Guaranteed Annuities - MYGAs (updated Thursday, 2025-03-06). These checklists are sorted by the surrender charge period. We change these lists daily and there are frequent adjustments. Please bookmark this web page and return to it frequently. For expert assistance with multi-year ensured annuities call 800-872-6684 or click a 'Obtain My Quote' button beside any kind of annuity in these checklists.

You'll also take pleasure in tax obligation advantages that bank accounts and CDs do not provide. Yes. For the most part delayed annuities enable a total up to be withdrawn penalty-free. However, the allowable withdrawal quantity can differ from company-to-company, so make sure to review the product brochure very carefully. Deferred annuities typically permit either penalty-free withdrawals of your earned interest, or penalty-free withdrawals of 10% of your agreement worth yearly.

The earlier in the annuity duration, the higher the charge percent, described as abandonment fees. That's one reason why it's ideal to stick to the annuity, when you dedicate to it. You can draw out whatever to reinvest it, but before you do, make sure that you'll still triumph this way, even after you figure in the abandonment fee.

The surrender charge might be as high as 10% if you surrender your contract in the initial year. Oftentimes, the abandonment cost will certainly decrease by 1% each contract year. A surrender cost would certainly be billed to any withdrawal more than the penalty-free quantity allowed by your postponed annuity agreement. With some MYGAs, you can make early withdrawals for emergencies, such as health and wellness costs for a severe illness, or confinement to an assisted living home.

You can establish up "systematic withdrawals" from your annuity. Your various other alternative is to "annuitize" your postponed annuity.

One America Long Term Care Annuity

Many delayed annuities allow you to annuitize your agreement after the very first agreement year. Interest gained on CDs is taxable at the end of each year (unless the CD is held within tax obligation competent account like an IRA).

Additionally, the rate of interest is not tired until it is eliminated from the annuity. Simply put, your annuity grows tax obligation deferred and the passion is worsened every year. However, window shopping is always a great concept. It holds true that CDs are insured by the FDIC. Nonetheless, MYGAs are guaranteed by the private states normally, in the variety of $100,000 to $500,000.

Annuity Patent

You have a number of alternatives. Either you take your money in a lump sum, reinvest it in an additional annuity, or you can annuitize your agreement, converting the lump sum right into a stream of income. By annuitizing, you will only pay taxes on the passion you get in each settlement. For the most part, you have thirty days to notify the insurance provider of your intents.

These features can differ from company-to-company, so make sure to discover your annuity's fatality advantage functions. There are a number of benefits. 1. A MYGA can indicate lower tax obligations than a CD. With a CD, the passion you gain is taxed when you make it, also though you do not get it till the CD develops.

Not just that, but the intensifying interest will certainly be based on an amount that has actually not already been taxed. Your beneficiaries will receive the complete account worth as of the day you dieand no surrender charges will certainly be deducted.

Your recipients can pick either to get the payment in a swelling amount, or in a collection of revenue repayments. 3. Frequently, when someone passes away, also if he left a will, a court chooses that obtains what from the estate as sometimes relatives will certainly say about what the will certainly methods.

With a multi-year fixed annuity, the owner has actually clearly assigned a recipient, so no probate is called for. If you contribute to an IRA or a 401(k) strategy, you obtain tax obligation deferral on the incomes, just like a MYGA.

Latest Posts

The Best Ways To Maximize Your Retirement Income In 2025

Neap Annuity

State Of New Jersey Teachers Pension And Annuity Fund